Closing your business

Closing your business

Are you consider closing your business? Or have you recently sold your business?

If so, do you know what your obligations are regarding your accounts?

If you are closing your business or the business has been sold, you need to get all the data entry up to date, for the final accounts to be completed by the accountant.

This involves reconciling all the bank accounts, loan accounts and managing any outstanding invoices and bills.

You also need to ensure all your employees final pays are processed.

It’s important that your accountant has the details of everything to do with the business sale - the contract and settlement documents etc.

If this sounds like a mammoth task we can help.

As your bookkeeper, we will check if you or your accountant will be cancelling all your relevant registrations such as:

It’s really important that registrations are not cancelled without checking with your accountant first.

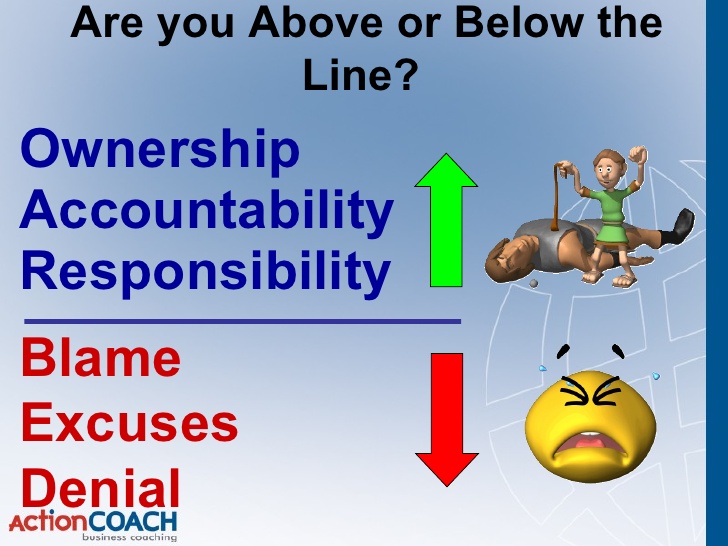

Sometimes business goes bad

Sometimes things go wrong, things that can be out of your control or can’t be helped, And the sad outcome of that is that businesses can go bad.

It’s obviously a challenging time when this happens. So, it’s important to understand what is involved.

Firstly, if you’re working with a bookkeeper and accountant, they can often identify when things aren’t going and can try to help you get your affairs in order. Unfortunately, sometimes this isn’t enough, and you have to call in the Liquidators.

The liquidation process will be dependent on your business structure, there are differences in the process for sole traders and companies.

The Liquidator will most likely contact your bookkeeper and accountant to obtain access financial records. Before providing any information, your bookkeeper and accountant should check that you are actually in liquidation. There are scammers out there. This is achieved by searching your company name or CAN on ASIC.

If you are in liquidation, you should also be aware that, as a creditor, your bookkeeper and accountant will most likely only continue doing any further work for you if the Liquidator has authorised the work.

As mentioned previously, liquidation is a challenging time. Understanding what is required of you and your bookkeeper can help ease the pain a bit.

We’re here to help you, every step along the way. Get in touch!