Reporting PAYGW correctly

Reporting PAYGW Correctly

PAYG and claiming tax deductions

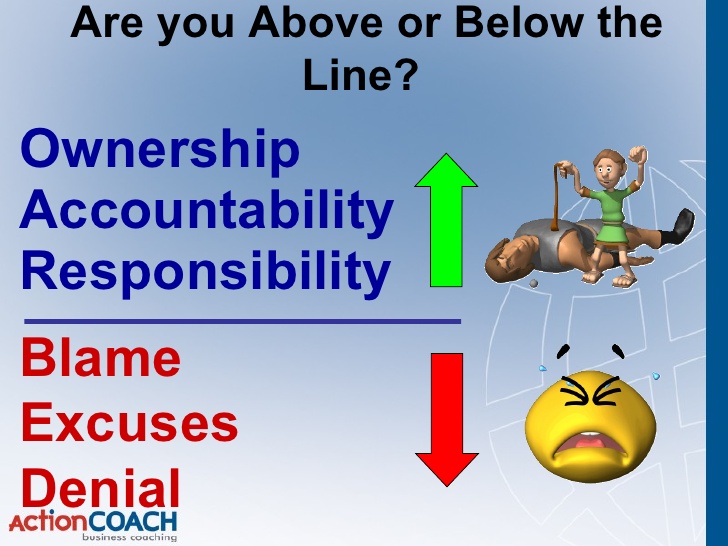

From July 1 2019, If you don’t meet PAYG withholding obligations for your workers, by not withholding tax from their payments and not reporting it to the ATO, you could lose your tax deduction.

This will apply to income tax returns lodged for the 2020 financial year and beyond.

If you withhold tax from payments to workers, you must withhold the required amount and report correctly to the ATO in order to receive a tax deduction for your business.

PAYG withholding and reporting obligations apply to payments for:

Withholding rules still apply to cash payments. Similarly, for non-cash payments such as property or exchange of services, withholding rules still apply even if your worker agrees to receive a non-cash payment in place of money.

PAYGW

The payment of PAYGW to the ATO is a separate issue. The new rules are aimed at getting employers to report correctly and on time. Once you have reported an amount to the ATO, they expect payment of that obligation by the due date.

If you make an honest mistake, such as treating an employee as a contactor, you won’t be penalised. You can correct your mistake by lodging a voluntary disclosure

Talk to us

Contact us to review your PAYGW reporting obligations.