Living above the line

Living above the line

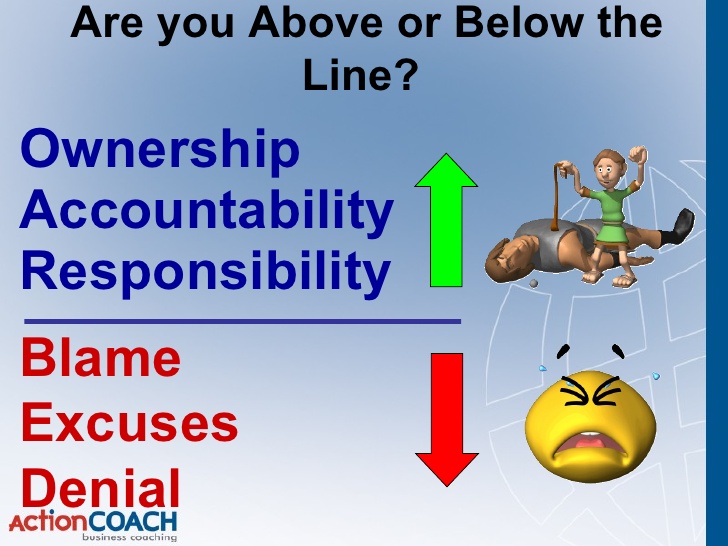

There are three winning behaviours and three responses that’ll sink your team.

Are you living above the line? If not, you need to get there, as it’s the easiest way to transform workplace culture and team performance.

Here’s how, using the OARBED behaviour model:

The acronym starts with OAR - when behaving above the line, one takes:

Ownership

Accountability

Responsibility

Below the line, BED, is defined as:

Blame

Excuse

Deny

No matter what, reacting in these ways is below the line.

For instance, consider the likely reaction of a naughty child caught in the act. If five-year-old Bobby is caught pulling his sister’s hair, he may resort to BED behaviour:

Blame: 'She made me do it.' Excuse: 'She pushed me first.' Deny: 'I didn’t even touch her.'

Adults don’t typically pull hair, but BED behaviour could look like this in your office: Someone misses a deadline… and they blame an internet dropout; make an excuse about not having the necessary information; or deny the project was their responsibility in the first place. This behaviour alienates oneself, while hurting team performance and morale.

On the other hand, paddling with our OAR means, regardless of our initial thinking, we must take ownership, accountability and responsibility. When we live above the line a resolution is found faster, individuals feel more supported and we’re more likely to learn from our mistakes.

OARBED has no hierarchy.

Would your team be comfortable calling you, or anyone else, out on below the line behaviour?

Remember, thinking below and acting below are not the same. It’s human nature to dip below the line in our minds, but it’s how we act that matters. Staying in BED is easy, but paddling with your OAR is much more effective and in time the whole team will be paddling in sync. Are you living above the line???

Therefore if you would like to know more about OARBED then feel welcome to contact us.

"The best apology is changed behaviour." - Anon