Developing great leadership

Developing great leadership to scale your business

There are several aspects of successfully scaling up your business one being having comprehensive systems. Another being developing great leadership.

Have you heard the quote,

“What got you here won’t get you there”?

These are wise words (and the title of a book we encourage you to read!) are from Marshall Goldsmith.

When choosing to scale your business many leaders focus on their systems and teams, which is important. But you should also focus on scaling yourself.

Developing great leadership

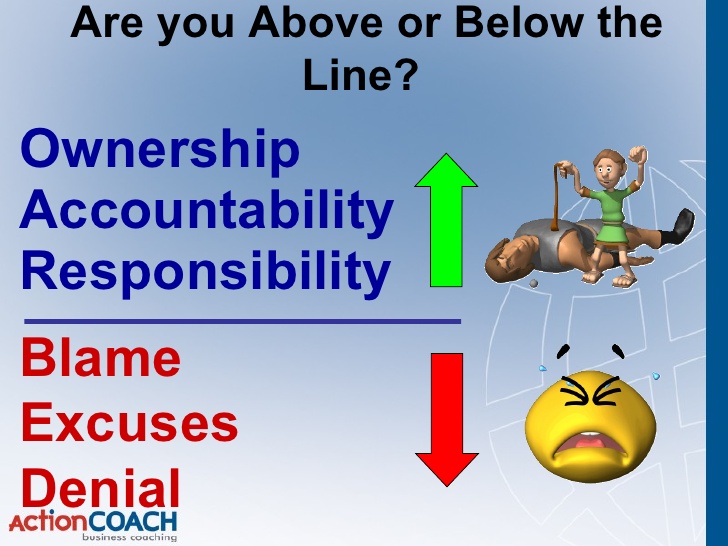

Most reasons why businesses fail, directly and indirectly, point to leadership failure.

From poor planning to poor hiring, poor communication to poor process, poor capacity to poor execution - most things can be fixed with great leadership.

Scaling the business will make new demands on a leader’s time and attention. And it’s critical that these are both focused on the right things:

1. Planning

Setting a clear vision and relevant business goals. Having a regularly reviewing progress. And resetting goals to drive performance improvement.

2. Inspiring

Motivating others to achieve more than before. Showing them their potential to make an impact.

3. Empowering

Enabling your team to find their own solutions by guiding them with your support, trust and encouragement.

4. Culture

Demonstrating allegiance to your team and standing for the business’s core values.

5. Innovating

Continuous improvement in people, product, and process.

6. Personal growth

Developing and supporting your future leaders with mentoring and guidance.

Great leadership is about influencing others in the direction of a common goal.

While there can only be one leader of a business, there are different areas that need individual leaders. People can lead multiple areas initially. But, as the business grows, look to empower others. Delegate the leadership of some areas to ‘leaders in training’.

On a scale from 1 to 10, how well do you rate your performance on the above six categories?

Where can you scale your leadership?

If you need help? Get in touch.

“The function of leadership is to produce more leaders, not more followers.” - Ralph Nader