Get on top of time wasters in your working week

Get on top of time wasters in your working week

There are 1,440 minutes in a day and each of us have the same allocated amount. Some people manage to achieve much more than others. So, how can we free up time to help lead a better business and ultimately a happier life?

The top 10 time wasters:

1. Lack of clear goals.

Planning and setting SMART goals provides clarity. SMART = Specific, Measurable, Attainable or Achievable, and most importantly Time-bound. Have your goals documented and visible.

2. A messy desk.

Desk clutter equals mind clutter. Tidy your work-space each day before you leave. Also consider how paperless you are; paper is part of the problem.

3. Procrastination and shifting priorities.

Avoid unnecessary pick up and put down. Multitasking is a productivity myth. Plan your day carefully and stay focused; don’t deviate unless it’s really necessary.

4. Interruptions (from humans and technology).

Establish ground rules for others, and set yourself clear parameters regarding your technology distractions, e.g. turn off your email notifications and only check emails between tasks. If it’s urgent, they’ll call or tap your shoulder.

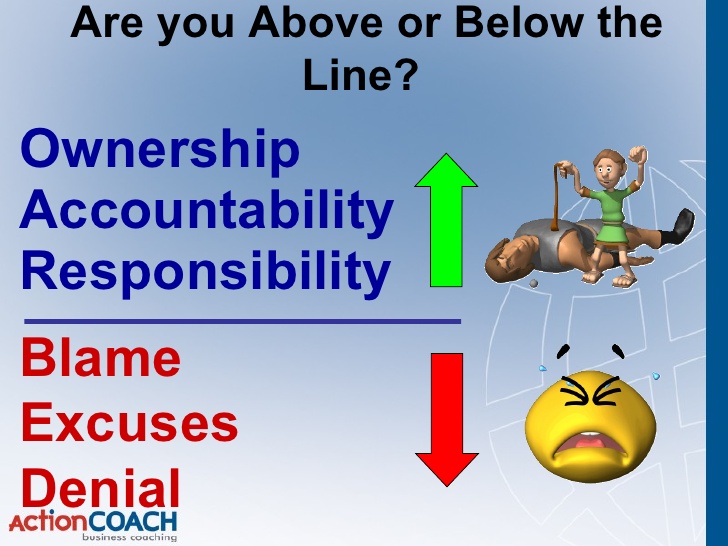

5. Ineffective delegation (and abdication).

Responsibility and doing are not the same. Invest time in creating clear processes and empower others to do more for you. When delegating a task, responsibility still falls on you… and without a clear process, you are setting someone up to fail which will ultimately reflect poorly on you.

6. Ineffective systems.

Mistakes can usually be attributed to ineffective systems. Involve your team to get buy in and LEAN up processes where possible. Eliminate systems that don’t add value; always go back to your purpose.

7. Inability to say 'no'.

We are defined not just by what we say yes to, but what we say no to. Planning helps us to say no to things that don’t align with our purpose and goals.

8. Ineffective meetings.

Every meeting needs a purpose, an agenda and clear objectives. Stick to the agenda, document outcomes and consider which meetings could be replaced with reporting or an online planning tool (such as Trello).

9. Ineffective email use.

Think twice before playing email tennis. Ask yourself: 1.) Is the directive clear? 2.) Is the tone correct? 3.) Is it better to walk five steps to have a conversation?

10. Poor planning.

Effective planning has three key components: a one page plan (with goals, KPIs and required actions), regular reporting to ensure continuous improvement, and accountability.

What are your biggest time wasters? Identify your top 3 and take ownership and responsibility to minimise them today!